In today’s fiercely competitive business landscape, understanding and optimizing the Lifetime Value of a Customer (CLV) is essential for long-term success. CLV serves as a powerful metric that not only indicates a company’s profitability but also guides strategic decisions in marketing, customer service, and product development. As we advance into 2024, integrating effective email marketing strategies to enhance CLV has become increasingly vital. This comprehensive guide explores the three essential components of the CLV formula, unveils hidden gem strategies to maximize CLV, and demonstrates how Prism Reach, an innovative AI-powered SaaS solution, can elevate your email marketing efforts to new heights.

Key Facts and Statistics

Understanding the landscape of CLV and its impact on email marketing is crucial. Here are some key statistics for 2024:

- CLV Importance: Companies that effectively leverage CLV strategies see up to a 25% increase in profitability.

- Email Marketing ROI: For every $1 spent on email marketing, businesses can expect an average return of $42.

- Personalization Impact: Personalized emails can generate up to 760% more revenue compared to non-personalized campaigns.

- Customer Retention: Improving customer retention by just 5% can increase profits by 25% to 95%.

- Engagement Rates: Email campaigns with dynamic content see a 22% increase in engagement.

Upgrade Your Email Marketing with AI Personalization!

Understanding the Customer Lifetime Value Formula

Customer Lifetime Value (CLV) is a metric that estimates the total revenue a business can expect from a single customer account throughout their relationship. Calculating CLV accurately allows businesses to make informed decisions about customer acquisition, retention, and marketing strategies.

Basic CLV Formula

The most commonly used CLV formula is:

CLV = (Average Order Value) x (Number of Repeat Sales) x (Average Retention Time)

For example, if your average order value is $100, customers make 5 repeat purchases, and the average retention time is 2 years, your CLV would be:

CLV = $100 x 5 x 2 = $1,000

This means that, on average, each customer is worth $1,000 to your business over their lifetime.

Advanced CLV Calculations

While the basic formula provides a straightforward calculation, more advanced CLV models incorporate additional factors for greater accuracy:

- Customer Acquisition Cost (CAC): CLV can be adjusted by subtracting CAC to determine the net value of each customer.

- Discount Rate: Applying a discount rate accounts for the time value of money, providing a present value of future cash flows.

- Churn Rate: Incorporating churn rate helps in predicting the likelihood of customer retention over time.

For instance, a SaaS company with an average customer acquisition cost of $200, generating $100 in revenue per month, and retaining customers for 12 months would calculate net CLV as follows:

CLV = ($100 x 12) – $200 = $1,200 – $200 = $1,000

Practical Examples

Consider an eCommerce business that sells luxury watches. By analyzing their CLV, they find that their average customer spends $500 per year over three years, resulting in a CLV of $1,500. By understanding this value, the business can allocate their marketing budget more effectively, ensuring they invest in strategies that attract and retain high-value customers.

5 Hidden Gem Strategies to Enhance Customer Lifetime Value

Maximizing CLV requires innovative strategies that go beyond traditional approaches. Here are five hidden gem strategies that can significantly enhance your ability to calculate and maximize CLV effectively:

Incorporate Predictive Analytics

Strategy: Use predictive analytics to forecast future customer behavior based on historical data, allowing for proactive engagement strategies.

- Effectiveness: High; predictive models can identify which customers are likely to become high-value and which may churn.

- Obscurity: Many businesses use basic CLV calculations without leveraging predictive insights.

- Ease of Implementation: Requires access to data analytics tools but is increasingly feasible with modern software solutions.

- Uniqueness: This strategy focuses on anticipating customer needs rather than reacting to them.

Example: Utilizing Prism Reach’s AI capabilities, a retailer can analyze past purchase data to predict which customers are likely to make repeat purchases, allowing for targeted marketing efforts that enhance CLV.

Customer Journey Mapping

Strategy: Create detailed maps of customer journeys to identify key touchpoints that influence CLV, allowing for targeted improvements.

- Effectiveness: High; understanding the customer journey helps tailor interactions that enhance satisfaction and retention.

- Obscurity: While journey mapping is known, its direct application to CLV enhancement is less common.

- Ease of Implementation: Requires initial setup and analysis but can be done with existing customer data.

- Uniqueness: This approach provides a holistic view of customer interactions, enabling personalized engagement strategies.

Example: By mapping out the customer journey using Prism Reach, a company identifies that most high-CLV customers engage heavily with post-purchase emails. They can then enhance these touchpoints to further increase retention and CLV.

Tiered Loyalty Programs

Strategy: Develop tiered loyalty programs that reward customers based on their spending levels, encouraging higher purchases over time.

- Effectiveness: Tiered programs can lead to increased spending as customers strive to reach higher tiers for better rewards.

- Obscurity: While loyalty programs are common, tiered structures are less frequently implemented effectively.

- Ease of Implementation: Requires program design and management but can be automated with loyalty software.

- Uniqueness: This approach incentivizes long-term relationships by rewarding sustained engagement.

Example: A subscription box service creates a tiered loyalty program using Prism Reach, where customers earn points for each purchase. Higher tiers offer exclusive products and early access, motivating customers to increase their spending to unlock greater rewards.

Dynamic Pricing Strategies

Strategy: Implement dynamic pricing based on customer behavior, purchase history, and market conditions to maximize revenue from high-value customers.

- Effectiveness: Can significantly increase revenue per transaction and enhance overall CLV.

- Obscurity: Many businesses still use static pricing models without considering dynamic adjustments.

- Ease of Implementation: Requires a pricing strategy overhaul but can be automated with the right tools.

- Uniqueness: This strategy allows for flexibility in pricing that responds directly to customer behavior.

Example: An online retailer uses Prism Reach to adjust prices for returning customers based on their purchase history, offering discounts to high-value customers to encourage repeat purchases.

Community Engagement Initiatives

Strategy: Foster a community around your brand through social media engagement, forums, or events that encourage customer interaction and loyalty.

- Effectiveness: Strong communities can lead to increased brand loyalty and higher CLV as customers feel more connected to the brand.

- Obscurity: Many brands focus solely on transactional relationships without building community ties.

- Ease of Implementation: Requires ongoing effort but can leverage existing social media platforms or community tools.

- Uniqueness: This strategy emphasizes emotional connections rather than just transactional interactions.

Example: Harley-Davidson’s HOG (Harley Owners Group) community fosters a sense of camaraderie and shared passion among its customers. By organizing events, forums, and exclusive experiences, Harley-Davidson builds a loyal customer base with exceptionally high CLV.

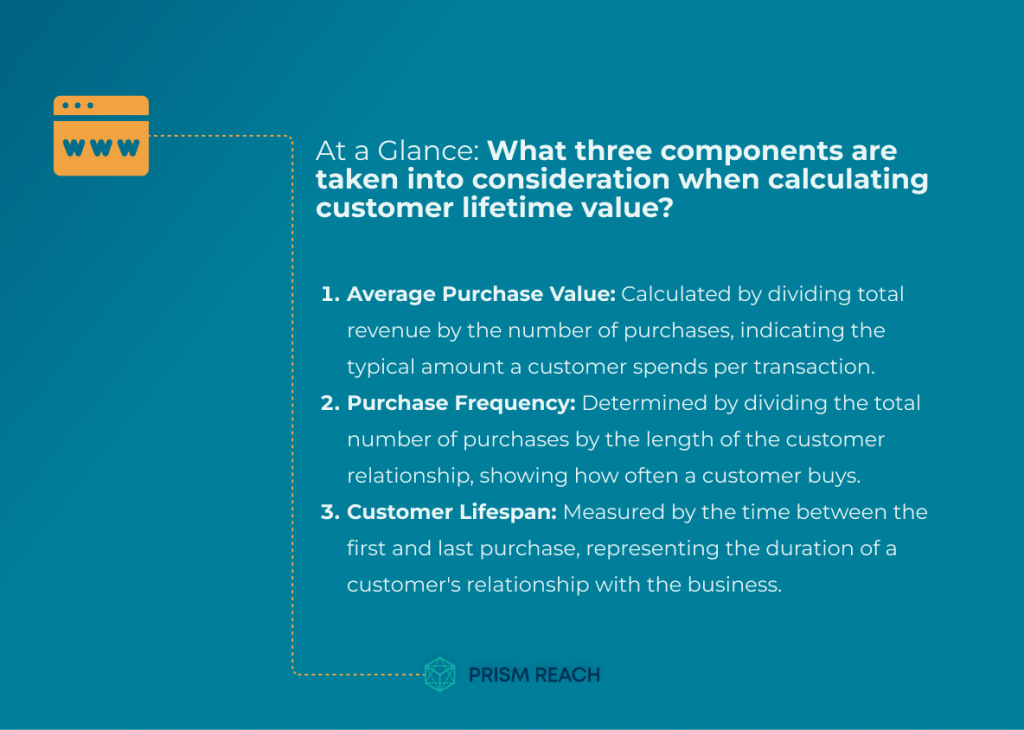

Comparison: What Three Components Are Taken Into Consideration When Calculating Customer Lifetime Value

1. Average Purchase Value

- Advantages:

- Increases revenue per transaction.

- Encourages higher customer spending and reflects a strong product value perception.

- Improves gross margin and supports premium pricing strategies.

- Disadvantages:

- May deter price-sensitive customers.

- A higher average purchase value might come with an increased risk of customer churn if prices are perceived as too high.

2. Purchase Frequency

- Advantages:

- Boosts overall revenue by encouraging more frequent transactions.

- Helps build customer loyalty and smoothens revenue flow.

- Can reduce marketing costs as recurring customers may require less re-engagement.

- Disadvantages:

- An increased frequency could potentially lead to higher operational costs.

- There’s a risk of customer fatigue if communications or promotions become too frequent.

3. Customer Lifespan

- Advantages:

- Maximizes the total revenue derived from each customer over time.

- Supports long-term planning and relationship building.

- Reduces acquisition costs as longer customer relationships enhance loyalty.

- Disadvantages:

- Maintaining long-term relationships can be costly.

- Requires continuous delivery of value to keep the customer engaged over time.

4. Customer Acquisition Cost (CAC)

- Advantages:

- Guides marketing budget allocation by highlighting the cost efficiency of acquisition channels.

- Helps identify cost-effective channels and optimize marketing strategies.

- Supports clear ROI calculations.

- Disadvantages:

- High acquisition costs can reduce overall profitability.

- It may be difficult to measure accurately, especially when multiple channels are involved.

5. Customer Retention Rate

- Advantages:

- Indicates strong customer satisfaction and long-term revenue potential.

- Reduces churn and lowers the overall cost of acquisition.

- Builds brand loyalty over time.

- Disadvantages:

- Requires ongoing investment in customer service and engagement strategies.

- It can be challenging to improve quickly, as retention improvements often take time to materialize.

6. Gross Margin per Customer

- Advantages:

- Reflects the true profitability of each customer.

- Informs pricing strategies and helps manage costs effectively.

- Supports revenue forecasting and can guide product development.

- Disadvantages:

- Gross margin can be affected by external factors and market fluctuations.

- It may vary widely over time, making consistent tracking challenging.

7. Customer Segmentation and Targeting

- Advantages:

- Enhances marketing efficiency by personalizing experiences for different customer groups.

- Improves conversion rates and helps identify high-value customers.

- Informs product development and tailors messaging to specific interests.

- Disadvantages:

- Implementation can be complex and may risk over-segmentation.

- Requires detailed data collection and analysis, which can be time-consuming.

8. Cross-Selling and Upselling Opportunities

- Advantages:

- Increases the average order value and overall revenue.

- Enhances customer satisfaction by offering relevant product recommendations.

- Leverages the existing customer base to support product diversity.

- Disadvantages:

- There’s a risk of annoying customers with too many sales pitches.

- May require additional resources to implement effectively without overwhelming the customer.

9. Customer Loyalty and Advocacy

- Advantages:

- Promotes repeat business and generates valuable word-of-mouth referrals.

- Enhances brand reputation and reduces future marketing costs.

- Increases the overall customer lifetime value.

- Disadvantages:

- Building loyalty takes time and consistent effort.

- Requires ongoing engagement and a strong value proposition to sustain advocacy.

10. Customer Feedback and Satisfaction

- Advantages:

- Provides insights to improve product offerings and overall customer experience.

- Builds customer trust and supports effective retention strategies.

- Helps identify areas for improvement and tailor future initiatives.

- Disadvantages:

- Managing and analyzing feedback can be resource-intensive.

- Negative feedback, if not addressed promptly, can highlight areas of weakness.

11. Competitive Landscape and Market Trends

- Advantages:

- Informs strategic decisions and identifies new market opportunities.

- Supports competitive positioning and guides innovation.

- Enhances understanding of the market, helping to stay ahead of competitors.

- Disadvantages:

- Requires continuous monitoring and rapid response to shifts in the market.

- May necessitate frequent adjustments to strategies, leading to potential disruptions.

12. Technological Advancements and Innovations

- Advantages:

- Improves customer experience through enhanced operational efficiency.

- Supports personalized marketing and enables data-driven decisions.

- Facilitates scalability and keeps the business competitive.

- Disadvantages:

- High initial investment costs can be a barrier to adoption.

- Continuous updates and advancements require ongoing attention and resources.

This comparison helps in understanding how each metric not only contributes to the overall financial and strategic health of the business but also presents challenges that need to be managed. The optimal balance will depend on your specific business context, market conditions, and strategic goals.

Benefits of Using Prism Reach

Leveraging the right tools can amplify the effectiveness of your email marketing efforts. Prism Reach is an innovative AI-powered SaaS solution designed to enhance the effectiveness of email marketing campaigns through deep personalization and automation. Here are three key benefits of using Prism Reach:

- AI-Powered Personalization: Prism Reach utilizes sophisticated AI algorithms to create detailed user avatars based on subscriber behavior and preferences. This enables the creation of highly personalized email content that resonates with each individual recipient, increasing engagement and conversion rates.

- Dynamic Content Selection: The platform’s ability to dynamically select and tailor content based on real-time data ensures that your emails are always relevant and engaging to your audience. This real-time adaptation keeps your content fresh and aligned with subscriber interests.

- Performance Monitoring: Prism Reach provides robust tracking tools to monitor the effectiveness of your email campaigns, including open rates, click-through rates, and engagement metrics. This data-driven approach allows for continuous optimization and improvement of your email strategies, ensuring sustained campaign success.

Prism Reach’s Features Enhancing Personalization

- Content Clustering: Groups website content and social media posts into relevant categories, enabling targeted messaging in your emails.

- User Avatars: Creates personalized profiles for each subscriber, ensuring that email content can be tailored to individual preferences and behaviors.

- AI-Generated CTAs: Automatically generates and updates CTAs in your emails based on subscriber interactions and seasonal trends, enhancing engagement and deliverability.

Integrating Hidden Gem Strategies with Prism Reach

To fully capitalize on the hidden gem strategies discussed earlier, integrating them with a powerful tool like Prism Reach can streamline and enhance their effectiveness. Here’s how Prism Reach can support each of the five hidden gem strategies:

- Incorporate Predictive Analytics: Prism Reach’s AI capabilities allow you to forecast future customer behavior by analyzing historical data, enabling proactive engagement strategies that target high-value customers and mitigate churn risks.

- Customer Journey Mapping: Prism Reach facilitates detailed customer journey mapping by tracking and analyzing each touchpoint. This insight helps identify key moments to enhance customer interactions and boost CLV.

- Tiered Loyalty Programs: Prism Reach supports the creation and management of tiered loyalty programs. By tracking customer spending and engagement, the platform automatically assigns customers to appropriate tiers and delivers tailored rewards.

- Dynamic Pricing Strategies: Prism Reach automates dynamic pricing adjustments based on real-time data analysis, ensuring that pricing strategies maximize revenue from each customer.

- Community Engagement Initiatives: Prism Reach can integrate community engagement data into your email marketing strategies, allowing you to personalize communications based on community interactions and participation levels.

Prism Reach in Action: Real-World Applications

To illustrate the practical benefits of Prism Reach, let’s explore a few real-world applications:

Case Study: Boosting Engagement with Interactive Content

A mid-sized eCommerce company implemented interactive polls within their monthly newsletters using Prism Reach. By analyzing the responses, they were able to segment their audience more effectively and tailor their product recommendations accordingly. This led to a 300% increase in click rates and a 20% boost in overall sales.

Case Study: Enhancing Personalization with AI

A global retailer utilized Prism Reach’s AI-powered personalization to generate personalized subject lines and content blocks based on individual browsing and purchase history. This personalization strategy resulted in a 41% increase in revenue and a significant reduction in unsubscribe rates.

Case Study: Gamification for Increased Engagement

A digital magazine incorporated spin-to-win games within their email campaigns using Prism Reach. Subscribers engaged with the gamified content, leading to a 15% increase in engagement rates and a higher conversion rate on promotional offers.

Prism Reach: The Tool for Maximizing CLV

Prism Reach stands out as a vital tool for businesses aiming to maximize their CLV through email marketing. Here’s how Prism Reach supports and enhances each of the hidden gem strategies:

- Incorporate Predictive Analytics: Prism Reach leverages advanced AI to predict customer behavior, enabling businesses to target high-value customers and implement strategies to reduce churn.

- Customer Journey Mapping: The platform tracks customer interactions across multiple touchpoints, providing insights that help businesses refine their engagement strategies to enhance CLV.

- Tiered Loyalty Programs: Prism Reach manages tiered loyalty programs by automatically categorizing customers and delivering personalized rewards, fostering long-term loyalty and increased CLV.

- Dynamic Pricing Strategies: Prism Reach automates dynamic pricing adjustments based on real-time data analysis, ensuring that pricing strategies maximize revenue from each customer.

- Community Engagement Initiatives: The platform seamlessly integrates community engagement data into email campaigns, allowing businesses to gather and act on customer insights to improve satisfaction and retention.

Practical Tips for Maximizing CLV through Email Marketing

To effectively maximize CLV through email marketing, consider the following practical tips:

Personalization Techniques

- Use subscriber data to personalize subject lines and email content.

- Segment your audience based on behavior, purchase history, and preferences.

- Implement dynamic content blocks that adapt to individual subscriber interests.

Automation Best Practices

- Set up automated email workflows for welcome series, cart abandonment, and post-purchase follow-ups.

- Use predictive analytics to send emails at optimal times for each subscriber.

- Automate cross-selling and upselling campaigns based on customer behavior.

Continuous Improvement and Adaptation

- Regularly analyze email campaign performance metrics to identify areas for improvement.

- Gather and integrate customer feedback to refine your email strategies.

- Stay updated with the latest email marketing trends and technologies to keep your campaigns relevant and effective.

Upgrade Your Email Marketing with AI Personalization!

Conclusion

Understanding and optimizing the Lifetime Value of a Customer is a game-changer for businesses aiming to thrive in today’s competitive environment. By mastering the CLV formula and implementing innovative strategies such as predictive analytics, customer journey mapping, tiered loyalty programs, dynamic pricing strategies, and community engagement initiatives, you can significantly enhance your CLV and drive long-term profitability.

Integrating advanced tools like Prism Reach into your email marketing efforts further amplifies these strategies. Prism Reach’s AI-powered personalization, dynamic content selection, and comprehensive performance monitoring enable businesses to create highly targeted, engaging, and effective email campaigns that resonate with their audience and maximize CLV.

As you continue to navigate the complexities of email marketing, remember that maximizing CLV is an ongoing process. Continuously monitor and analyze your CLV metrics, gather customer feedback, and adapt your strategies to meet evolving customer needs. Embrace the power of data-driven insights and advanced technologies like Prism Reach to cultivate lasting, profitable relationships with your customers and achieve unprecedented business growth.

Invest in understanding and enhancing your Customer Lifetime Value today, and watch your business soar to new heights. With the right strategies and tools, you can create a customer-centric approach that drives engagement, loyalty, and sustained revenue growth.

Sources

- Thryv: The Magic of Customer Lifetime Value for Local Businesses

- Bloomreach: Customer Lifetime Value Guide

- Wharton Online: Why Customer Lifetime Value Matters

- Qualtrics: How to Calculate Customer Lifetime Value

- Customer Success Collective: Customer Lifetime Value – How to Calculate and Increase It